How Much Money Did The Us Raise For Ww2

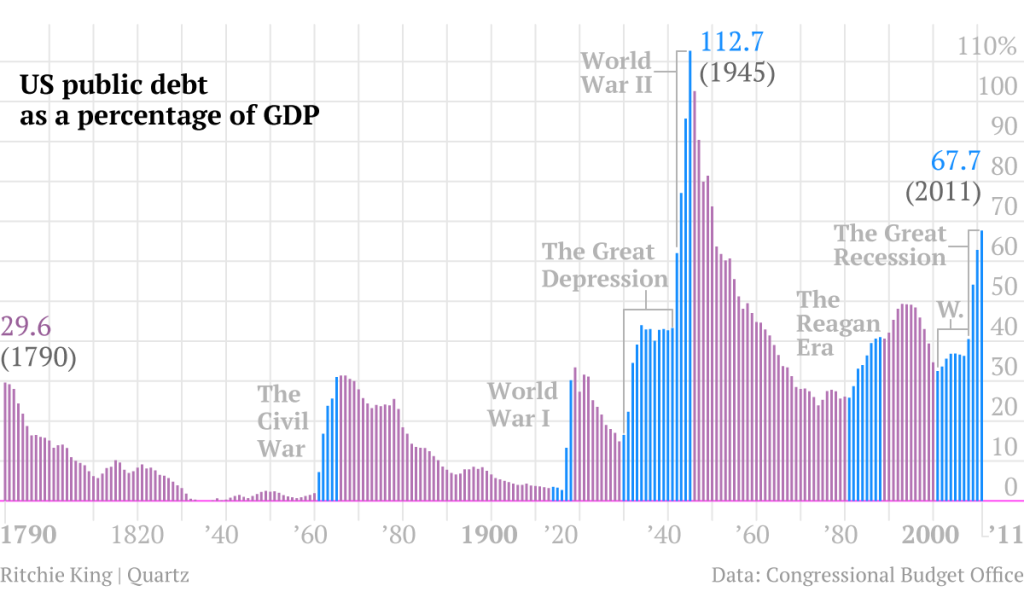

Equally the high-stakes wrangling over the fiscal cliff gets underway, we though information technology might be the proper moment to remind everybody just how the United States managed to become the world'southward biggest debtor.

And so, here's how.

Freedom ISN'T Costless

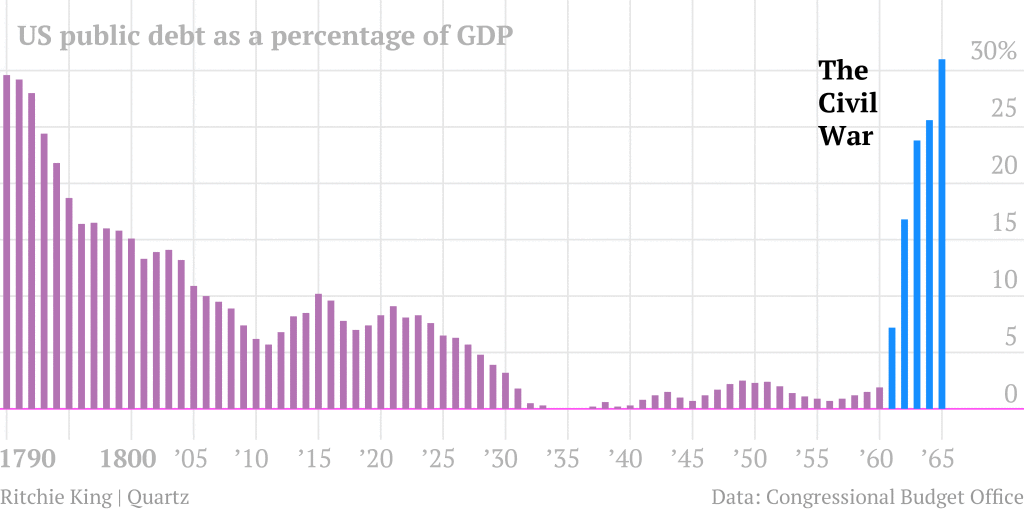

The U.s.a. was born in debt. The primeval total reckoning of Us national debt was compiled by Alexander Hamilton, the showtime United states Treasury Secretarial assistant, who was sort of like the Nate Argent of his era--a self-taught economist.

The analysis dates to 1790 and puts the newborn US at around a xxx% debt-to-Gross domestic product ratio, with the debt a chip higher than $75 million. Where did that debt come from? Well, the Continental Congress, the rough equivalent of the Federal government in revolution-era America, lacked the power to taxation. It first tried to pay for stuff by printing coin. This currency, known as the Continental, collapsed. The nascent United states of america authorities also raised cash by borrowing under all sorts of authorities. This National Agency of Economic Research working paper lists them:

These included certificates issued by the Registrar of the Treasury, the Commissioners of Loans of the States, the Commissioners for the aligning of accounts of the Quartermaster, Commissary, Infirmary, Wear and Marine Departments, the Paymaster General, and the Commissioner of Army Accounts. In addition, interest on these certificates had oft been paid in further certificates known every bit 'indents of interest.'

All in, the US owed most $xi.seven million to foreigners, mostly to Dutch bankers and the French regime, and about $42 million to domestic creditors. U.s. besides had a ton of debt (nigh $25 million, Hamilton reckoned), which the Federal Authorities causeless--have a hint, euro zone!--in 1790.

Equally Secretary of the Treasury, Hamilton was light amplification by stimulated emission of radiation-focused on the debt, not so much to pay it off, only rather simply to ensure that the fledging authorities could make all its payments to creditors. How? Well, tariffs and taxes. Americans were cool with that? No, 0f grade not. People hated it. After all, the country had just fought a state of war inspired in office by a defection confronting the revenue enhancement imposed by the British.

Just the federal government stuck to its guns, literally suppressing an armed anti-tax uprising in western Pennsylvania in 1794, known as the Whiskey Rebellion. Meanwhile, the economic system grew, helping to shrink debt-to-Gross domestic product. Later on, Hamilton's curvation-nemesis, Thomas Jefferson, was even more focused on paying off the debt as fast equally possible, driving U.s. debt-to-GDP below ten%. All this work was undone, when the US had to borrow heavily to finance the war of 1812.

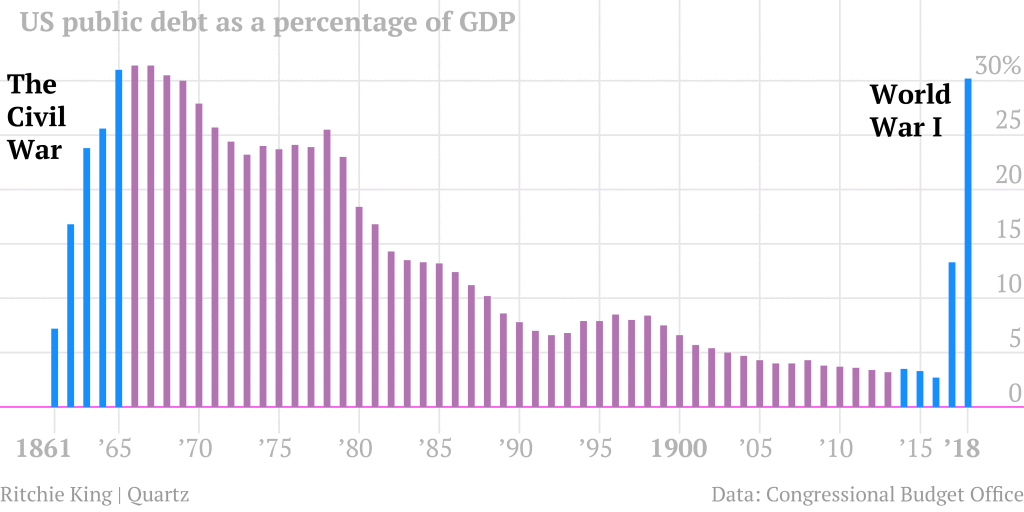

Ceremonious State of war

The side by side major surge in debt coincided with the US Civil War. The federal government was most debt-free before the war. The public debt surged from about $65 million in 1860 to $ii.76 billion in 1866. (The Lincoln administration also signed into constabulary the first income tax in the country's history in 1862, which was repealed 10 years after.) The debt would never become below $900 meg over again. Simply a surge of late-19th-century economical growth, with a chip of inflation, helped the U.s.a. gradually reduce the the Civil War debt as a percent of economic output.

IN THE TRENCHES

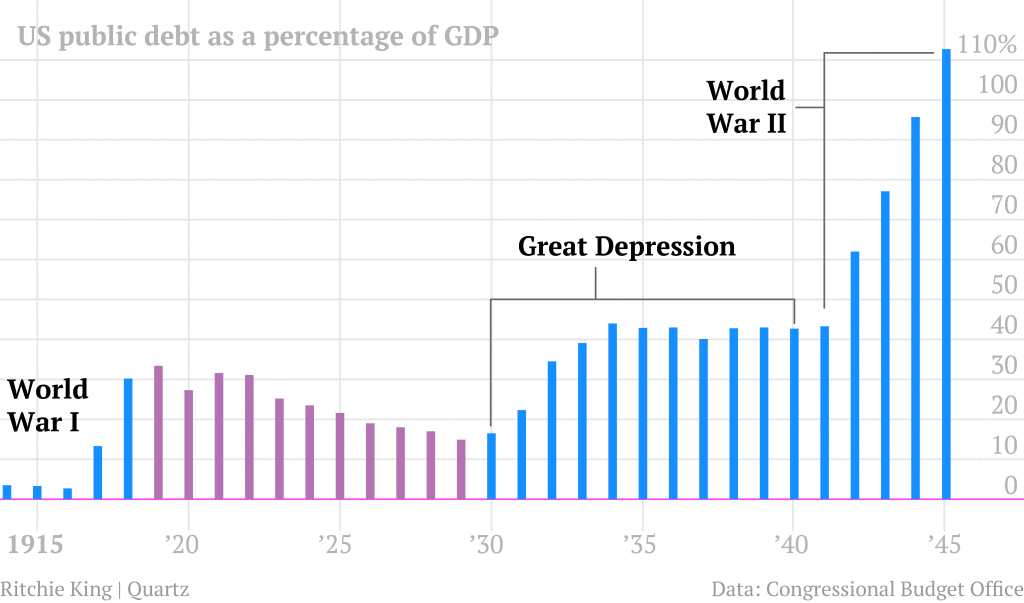

Again, from a Gdp perspective, the US was almost debt-gratuitous before sending the doughboys to France. In 1916, as a share of the economy the debt accounted for but 2.7% . The surge in debt associated with World War I was financed largely by selling bonds to the U.s. public. (By the time the U.s. entered the war, pretty much all the other major powers were already in it up to their necks, and thus, didn't take any coin to lend.)

In the aftermath of the war, the Uncle Sam hit a new tape high debt-to-Gross domestic product of about 33%, with more than $25 billion in debts, or almost $334 billion in today's dollars. But with a combination of budget surpluses, expenditures aimed explicitly at paying off debt early, and payments from the losers of state of war, the US made significant progress in whittling the debt down. It savage by more than $9 billion by 1930, a reduction of more than than a third.

This period coincided with a menstruation of Republican dominance in the US, in which taxes were cut repeatedly from high wartime levels. Only at the same time in that location was widespread agreement that taxes had to exist sufficient to pay down the debt.

It's also worth noting that this is the flow when the US congress effectively ceded a large part of its say-so over how much the country borrows. Before World War I, the Congress voted to approve the individual debt sales that were used to finance projects like the construction of the Panama culvert and the the Spanish-American state of war. To give the Treasury more flexibility to raise money during World State of war I, the Congress agreed to set an overall limit to what the Treasury could borrow, only not to need a say on each individual sale of Treasury bonds. That overall limit is the ancestor of the debt limit that was the source of so much consternation in belatedly 2011.

THE GREAT Low

This is really the start of the very familiar political arguments near the role of regime spending and economic growth. The nautical chart higher up shows the relationship betwixt debt and growth. Every bit the size, scope and part of regime changed drastically under Franklin D. Roosevelt and his New Deal, the US posted its biggest-always peacetime debt increase. The debt jumped by 150% from 1930 to 1939, when it was at around $40.44 billion (virtually $673 billion in today'southward money.) At the aforementioned time, the economic system--the bottom of the formula--collapsed, as did government revenues, which suffered from lower economic activeness. The consequence? A new debt-to-GDP record of 44% in 1934. And this was all earlier Pearl Harbor.

WORLD WAR Two

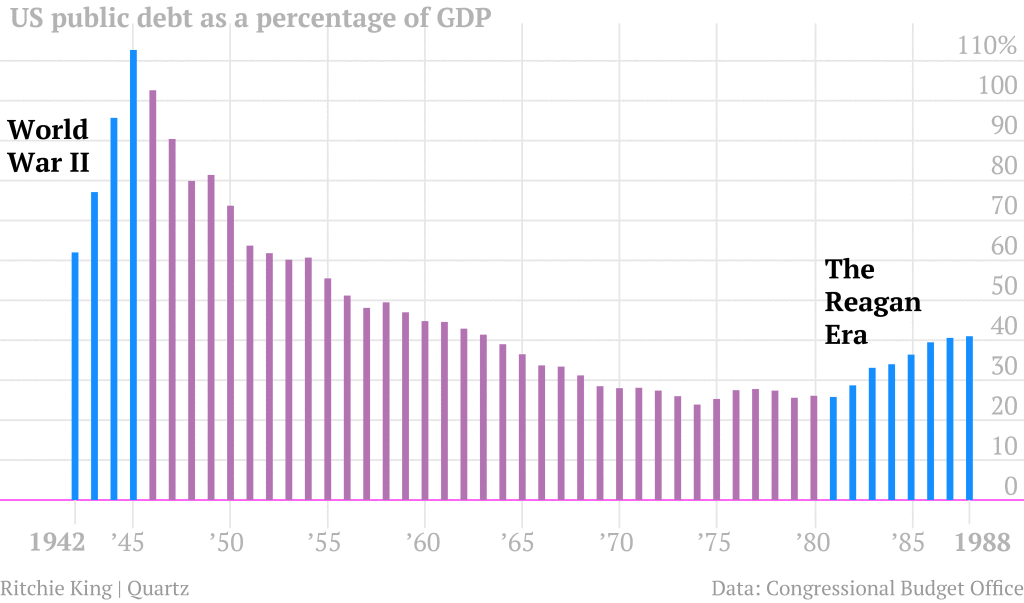

The debt-to-GDP ratio hitting its all-time record of 113% by war's end. Debt was at $241.86 billion in 1946, almost $ii.87 trillion in current dollars. Unlike later World State of war I, the Usa never really tried to pay downwardly much of the debt it incurred during World State of war II. Still the debt shrank in significance every bit the United states of america economy grew. It would take the debt-to-GDP ratio until 1962 just to get back to where the US was before the war. And with some fits and starts the debt load declined until striking its recent low in 1974 at 24%, when the debt outstanding held by the public was $343.seven billion ($one.61 trillion, in electric current dollars.)

REAGONOMICS

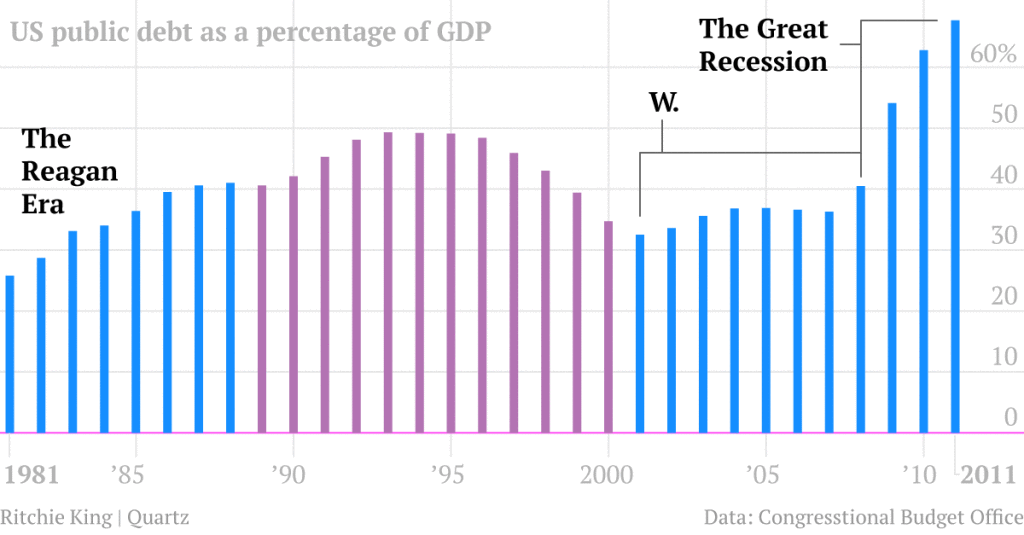

Debt-to-GDP began another upswing in the early 1980s, when the United states of america fell into a particularly nasty recession, set off by the Federal Reserve under Paul Volcker, who raised involvement rates to tape heights in gild to defeat inflation. Government receipts flattened thank you in role to the large, permanent revenue enhancement cuts that served equally one of the top accomplishments of President Ronald Reagan's start term. Spending jumped on both defense force and social programs. Deficits exploded, breaking with the United states tradition of only running large deficits during wartime. Debt-to-GDP began to climb and information technology hit a postwar peak of more than 49% in the early 1990s. In 1995, the publicly held debt outstanding was about $3.half-dozen trillion (or$5.47 trillion, in today's coin). Afterward that, a surge of economic growth, and increased revenues--thanks in part to the 1990 tax increases that cost the first President George Bush-league re-ballot and tax increases pushed through by the Clinton administration --helped curve the trajectory of the debt load back into line.

W.

The debt-load continued to expect increasingly manageable throughout the late 1990s, and it hitting its recent low of less than 33% of Gdp in 2001. At that point, things looked so expert on the debt forepart, that some were projecting the US would be within striking altitude of eliminating the entire debt within a decade. It didn't piece of work out that way.

A recession, combined with revenue enhancement cuts in 2001 and 2003 championed by President George W. Bush, severely crimped revenue. At the same time, spending surged both on military machine outlays subsequently Sept. eleven and on domestic programs such as an expensive prescription-drug benefit for senior citizens. As a result. US borrowing shot higher to finance the Bush Assistants'south efforts to stabilize the banking system every bit the economy teetered on the brink in 2008. Total regime debt available to exist traded publicly rose from $3.41 trillion in Dec 2000 to $5.fourscore trillion in Dec 2008, an increase of 70%; the debt-to-GDP ratio went upward from34.7% in 2000 to 40.v% in 2008.

THE Bully RECESSION

The great recession was the perfect storm to accident debt-to-Gross domestic product ratios skyward. GDP tumbled. That means that even without a spending increase, debt-to-Gdp would take jumped sharply. Moreover, government revenues shrank to their everyman level since 1950 -- as a percentage of Gdp -- because business activeness declined; that meant that debt levels would take to ascension, fifty-fifty without spending increases. And there were indeed spending increases. For instance, in 2009, outlays increased to more than 25% of GDP, the highest level since World War Two. That number declined somewhat, to 24.1%, where it rested in both 2010 and 2011. The U.Due south. started 2012 with $10.48 trillion in publicly traded debt. And by the end of last week, it was $11.42 trillion.

THE ROAD TO $xvi TRILLION

Because on peak of the roughly $eleven.4 trillion in US authorities debt, which tin can exist bought and sold and is floating around in fiscal markets, there's also most $v trillion in debt that the US authorities owes to itself. Those are largely obligations to the trust funds that are used to pay for programs such as Social Security. These aren't counted in debt-to-GDP charts published here, and are often excluded from such calculations. But if you did include this debt--and there's an argument to be fabricated that we should, since the authorities is on the hook to pay these claims--the U.s.a. debt-to-Gdp ratio was just under100% at the terminate of 2011.

And then what does that hateful? Hither's where we get into some arguments. Some economists say that the empirical record suggests that a debt-to-Gross domestic product ratio this high is bad for long-term economic growth considering the borrowing costs get a drag on other regime spending. Others argue that such observations aren't that helpful because information technology isn't as if big build-ups of debt e'er come before economic slowdowns. Sometimes large buildups of debt sometimesresult from shocks to economic growth--such as massive collapses in the financial system.

Still, many people are looking at Japan equally a potential cautionary tale of for the US. Nippon suffered its own real-estate bubble, bust, and banking failure in the early 1990s. Its debt-to-GDP has surged to more 200% in recent years. Back in the mid-1980s, information technology was around l%. And for what it's worth, it's not as if the Japanese economy shows signs of gathering long-term force any time soon.

Source: https://www.theatlantic.com/business/archive/2012/11/the-long-story-of-us-debt-from-1790-to-2011-in-1-little-chart/265185/

Posted by: morelandmand1981.blogspot.com

0 Response to "How Much Money Did The Us Raise For Ww2"

Post a Comment